Table of Contents

Market cap or market capitalization as it is usually called is one of the most frequently used values for analysing the size of a company among investors. It is total market value of the company’s stock which is available in the market for trading. Knowledge of market cap can help the investor examine a company’s size, competitive standing, and growth prospects, which is why it is worth familiarizing ourselves with this concept regardless of whether one is a beginning or an experienced investor.

Market Capitalisation

Though this term seems familiar to most people, the less literate may not have any clear concept about the term Market Capitalization.

Market capitalization is calculated using the formula:

Market Cap=Current Share Price × Total shares of Stock Market

Few points that are the interest of the Market Cap:

For instance, if a company has 1 million shares outstanding and its stock is trading at $50 per share, its market cap would be:

50×1000000= $500000053×1000000 = 50000000

This figure indicates the total value as perceived by investors as will be explained by use of stock price.

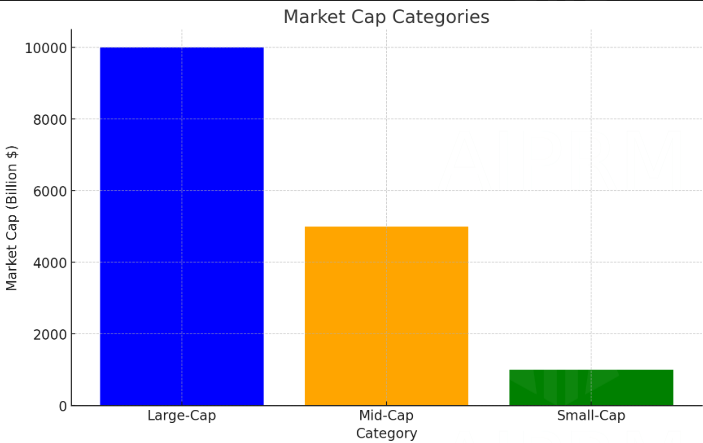

Market capitalization divides markets into different categories

Companies are generally classified into three broad categories based on their market cap:

1. Large-Cap Companies

Usually defined to have a worth of $10 billion or above.

These companies are usually those, which have been in an industry for years and are known for their financial stability and profitability.

Examples: Apple, Microsoft, Amazon.

Advantages: Lesser risk and predictability at slightly lower rates of returns.

Considerations: Junior status – it has a slower growth rate than other small business firms.

2. Mid-Cap Companies

Estimated at $2 billion to 10 billion worth.

Usually associated with companies in the growth cycle to provide middle-risk and middle-reward investment.

Advantages: It has higher growth potential as compared to the large-cap companies.

Considerations: Higher market riskensitivity.

3. Small-Cap Companies

It is turning over less than $2 billion.

The companies that have signed for such arrangements are often young or are involved in specific sectors.

Advantages: Strong synergies and high levels of first-moneypotential.

Considerations: Higher risk and even lack of good financial position.

What does Market Capitalization Tell?

1. Assessing Investment Risk

Through market cap, the investors are able to know the level of risk they are likely to take on an investment. Categorized by size, large-cap firms are least volatile compared to small-cap that may promise greater returns at higher risk.

2. Portfolio Diversification

Market cap can play significant roles in portfolio management as it can help the investors spread over the market with different types of companies that are big and large and need not necessarily possess higher growth ratios.

3. Comparing Companies

Market capitalization is easily understood, can be used to compare companies in different industries without regard to their revenue or levels of profitability.

Flaws of Global Market Capitalization

While market cap is a valuable metric, it has its limitations:

- Does Not Reflect Debt: Market capitalization does not include the debt and cash balance status of a business. It is, therefore, possible to find a company with a high market capitalization but in deep financial trouble.

- Fluctuates with Market Sentiment: Market capitalization of stocks may depend more on sentiments in a market rather than capable fundamentals hence its volatility.

- Ignores Operational Performance: Market capitalization reveals nothing regarding efficiency, profitability or general condition of the company.

Conclusion

Market capitalization is a routing measure widely used in investment with gives information about size and presence on the market of investors. But should not be used alone. It has to be used alongside other financial indicators and assessments that help to make the right investment decisions. Whether you are aligning yourself to the conventional concept of value investment that goes for blue chip stocks or are engaged in high risk absorption for high returns through penny stocks, Market capitalization is very vital tool as you think of your long-term investment strategy.