Table of Contents

Global factors, domestic positivity and healthy show by sectors made November an active month for the Indian stock market. Analyzing the leading gainers also provides information about the market directions but also indicates sectors and companies that make up the economy. In this case, it is high time that we guided deep down through the bigger name performers of the month.

Industry-wise gainers in November

The markets for most sectors including Information Technology, banking and insurance, pharmaceuticals and manufacturing registered very robust performances outshining their respective expectations. High domestic consumption, increase in infrastructure investment, and global demand for Indian services was evident in November that looked good for investors.

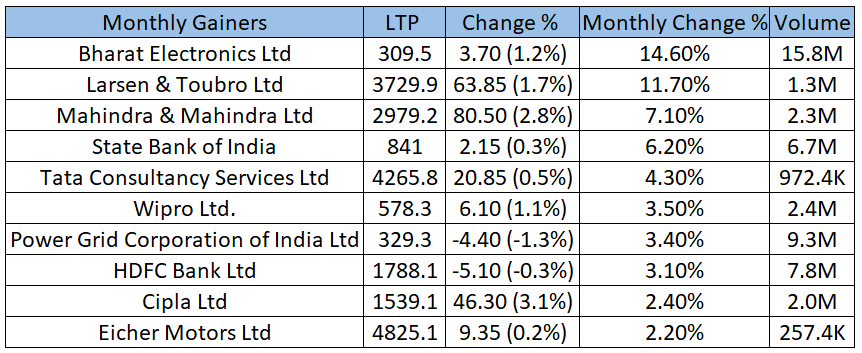

List of top 20 gainers in the month of November 2024

Description of the More Detailed Gainers

Bharat Electronics Ltd (BEL)

- Background and Performance : A defense electronics company, BEL, reported healthy growth in the month of November.

- Factors Contributing to Gains : Higher government defense outlay and export orders flight gave impetus to investor confidence.

Larsen & Toubro Ltd (L&T)

- Company Profile : Construction and engineering giant L&T also grew during the year.

- Market Sentiments : Positive results were attributed to its sound infrastructure expansion by government and healthy order backlog.

Mahindra & Mahindra Ltd (M&M)

- Performance Highlights : Two issues were significant for M&M: the company’s emphasis on electric vehicles and overall strong sales in automobiles.

- Key Drivers : The EV segment and the strength from the demand of suv car products also influenced it.

State Bank of India (SBI)

- Banking Sector Performance : SBI’s operation had a strong banking sector upturn and enhancement of the quality of its assets.

- Growth Factors : Upgrade of quarterly earnings’ forecast together with increasing credit circulation contributed to the stock’s increase.

TCS or Tata Consultancy Services Limited

- IT Sector Overview :TCS a IT titanic emerged higher due to increased global demands for service in the IT bracket.

- Key Events : The number of deals in particular from EW has remained stable and the fluctuation in currencies helped performance.

Wipro Ltd

- Growth Insights : The apparent strong requirements for digital transformation across the world benefited Wipro.

- Contributing Factors : new markets growth and cost advantages were other important factors that propelled this business forward.

Power Grid Corporation of India Limited

- Sector Importance : Further, the firm made a show of great operational performance and this form the basis of success.

- Performance Drivers : Expansion heightened through increasing interest in the integration of renewable energy into the power system.

HDFC Bank Ltd

- Banking Growth: HDFC Bank was equally equally assertive to the current situation demonstrated by its ability to record steady growth on both sides of the balance sheet that is; lending and deposit.

- November-Specific Growth : Consumer attitude was positive and there was demand during festive sessions.

Cipla Ltd

- Pharma Performance : Some of these specializations included respiratory and chronic therapies – area Cipla benefitted from.

- Growth Factors : Exports and domestic demand aided the stock higher growth as forecasted by the technical indicators.

Eicher Motors Ltd

- Automotive Sector Impact : Eicher’s Royal Enfield division remained way ahead in the mid-size bike segment.

ِ

Key Trends Across the Gainers

Most of the gains came from companies that demonstrated capability to survive the effects of the pandemic and rebound strongly. Strategic management, innovation, policies and sectoral influences. The figures are indicative of the broad belief in the country’s economic rebound.

Conclusion

Understanding the variables that played to produce this month’s greatest comparative additions to the Indian stock market to illustrate how the nation’s corporate sector has strengthened and evolved under changing international and local environments in November. The companies in the range of IT, banking, defense, and automotive industries looked healthy; upbeat fundamentals, good government support, and growing customers’ demand boosted their operations.

These trends should help investors quickly remain current on market developments and learn how the sector is shaping up. The organic growth and consistently high sales of companies like BE, SBI and TCS also shows the potential and the new business generation from India’s growth story. As we enter the next year, these companies, and other similar ones, will continue to have a big influence on how the market will develop.

This positivity seen in November points to an even better environment moving forward, and while certain industries such as renewable energy, electric vehicles, and technology are likely to dominate, this report seeks to explore. In this case, any long-term investors will need to find good stocks and ensure they have a diversified portfolio through which he will realize these growth possibilities.

FAQs

1. Why do we follow the gainer stocks?

That way; one can easily track and determine trends, sector strength, and other efficiencies hence investment opportunities from the top gainers’ list.

2. To which sector did November produce the best results?

IT, banking & defence were described as the most successful sectors ofEPS growth in November.

3. What does this mean for the retail investors?

It works on the basis of over-all market health and could be used as references for the retail investor to take the correct investment call.

4. Is this company good for long term investment?

Most of these companies areound with strong fundamentals, therefore appropriate for long-term investment.