Introduction

November is shaping up to be an exciting month for dividend enthusiasts in the Indian stock market. With companies across sectors preparing to reward their loyal shareholders, it’s the perfect time to explore opportunities for passive income. Dividend stocks not only provide a steady stream of cash flow but also signal a company’s financial health and commitment to its investors and oviously with a bit knowledge of different forms of dividend.

Whether you’re an experienced investor or just starting, understanding the upcoming dividend announcements can help you make smarter, well-timed investment decisions. So, grab your portfolio and let’s dive into what November has in store for dividend-seeking investors!

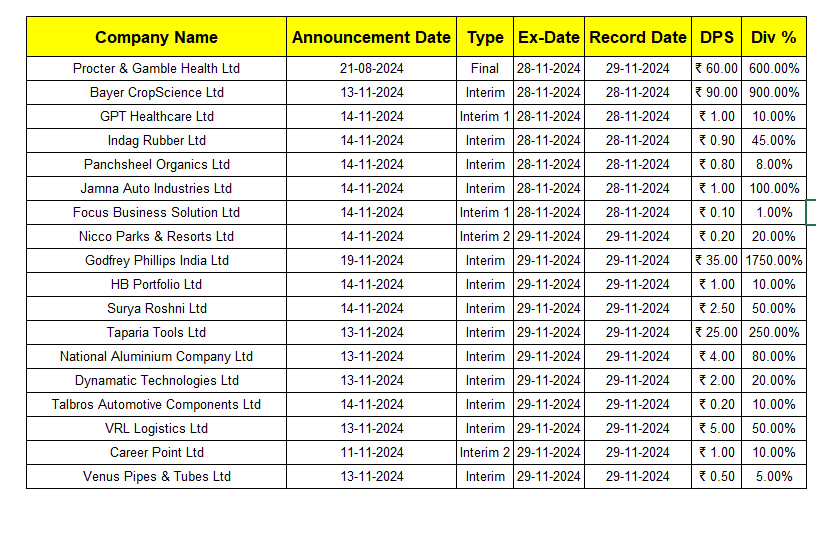

Here’s a list of upcoming dividend stocks of last week in November 2024

Understanding Dividends

What Are Dividends?

Dividends are a portion of a company’s earnings distributed to shareholders as a reward for their investment. They are typically paid in cash but can also come in the form of additional shares.

Types of Dividends

- Cash Dividends: Most common form of payout.

- Stock Dividends: Additional shares instead of cash.

- Special Dividends: One-time payouts due to exceptional earnings.

Dividend Yield vs. Dividend Payout Ratio

Dividend Yield: Indicates how much a company pays relative to its stock price.

- Payout Ratio: Percentage of earnings paid as dividends.

- Role of Dividends in Portfolio Growth

Dividends act as a cornerstone for wealth accumulation. By reinvesting them, investors can compound their returns over time. Additionally, they provide a cushion during volatile markets, offering consistent income even when stock prices fluctuate.

Key Dates to Remember

To capitalize on dividends, you must understand key dates:

- Ex-Dividend Date: Must own the stock before this date to qualify.

- Record Date: Determines eligible shareholders.

- Payment Date: When dividends are credited to your account.

How to Identify Dividend Stocks

Finding the right dividend stocks requires a blend of analysis and strategy:

- Look for companies with strong financials and low debt.

- Check their dividend history for consistency.

- Focus on sectors with stable demand, such as FMCG and utilities.

Sector-Wise Analysis of Dividend Stocks

- Banking and Financial Services :Known for regular payouts, banks like ICICI and Kotak Mahindra are investor favorites.

- Pharmaceuticals :Stable demand makes companies like Cipla and Lupin reliable dividend payers.

- Information Technology :IT firms are known for high profitability, making them attractive for dividends.

- FMCG and Consumer Goods :FMCG players like HUL and Nestle India have a long history of rewarding investors.

Tax Implications of Dividends

In India, dividends are taxable in the hands of investors. The tax rate depends on your income slab, making it essential to plan for tax-efficient investments.

Strategies for Dividend Investing

- High Yield vs. Growth Stocks :Balancing high-yield stocks with growth-focused ones ensures stability and potential for capital appreciation.

- Building a Dividend Portfolio :Diversify across sectors to reduce risk and maximize returns.

- Balancing Risk and Returns : Avoid over-concentration in one sector or stock.

- Risks Associated with Dividend Investing : While dividend investing is appealing, it comes with risks.

- Dividend Cuts: Companies might reduce or halt payouts.

- Over-Reliance: Can limit diversification.

Conclusion

Investing in dividend-paying stocks is a rewarding strategy for long-term wealth creation. By staying updated on upcoming dividends and market trends, you can maximize your returns while minimizing risks.

FAQs

1. How to Find the Best Dividend Stocks?

Look for companies with a strong track record of consistent dividends and robust financials.

2. Are Dividends Guaranteed?

No, dividends depend on a company’s profitability and management policies.

3. How Often Do Companies Pay Dividends?

Most Indian companies pay dividends annually, but some may do so quarterly or bi-annually.

4. What is a Dividend Aristocrat?

A company that has consistently increased its dividends over many years.

5. Can Small Investors Benefit from Dividends?

Absolutely! Even small payouts, when reinvested, can grow significantly over time.