Table of Contents

In India, the penny stocks have always been market puller for the investors looking for high return ratio. But are they really the path to easy money, or more like the gaming path leading to loss of any money?

This is especially so with the Indian stock market booming with high growth rates, many investors are now targeting these cheap stocks. Of course, large profits are always tempting, but so too are large losses. As the saying goes, be the game high risk high reward well penny stocks are a perfect definition of that phrase.

Here in this resource, let’s start with the basics and slowly discover Indian these stocks including top performers and basic research tools. Here we will discover what makes them go the extra mile, show you time tested strategies for investing and finding out what you should not do. In this article, you’ll be learning some baseline information that will help an experienced investor or even any newcomer lose money to these kind of stock investing world in India.

Getting to know penny stocks in India

Low risk stocks are also often referred to as penny stocks in India where most of the shares are sold below rs. 10. They are listed with SEBI but are high risk as they have high fluctuations and most information is kept hidden. Although they may present a quite attractive investment opportunity these high-risk investments should be approached with caution and proper research.

| Aspect | Description |

|---|---|

| Price | Below ₹10 |

| Risk | High |

| Regulation | SEBI |

| Potential Returns | Significant |

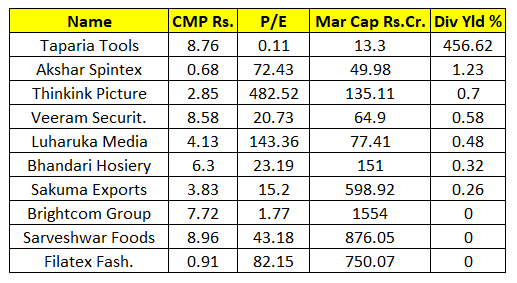

Top Performing Penny Stocks in India

Recent market performers

Considerations that Affect the Penny Stock Market

Various factors influence performance:

- Various factors influence Penny stock performance:

- Market trends and sentiment

- Company fundamentals

- Industry-specific catalysts

- Implementation of government polices and regulations

| Factor | Impact |

|---|---|

| Market trends | High |

| Company fundamentals | Moderate |

| Industry catalysts | Variable |

| Government policies | Significant |

Understanding these factors is crucial for making informed decisions when investing in penny stocks.

Descriptive, Analytical and Digressive Research Methods

Penny stock investing therefore requires a competent research and analysis for an investor to be in a position to make the right decisions. Here are key techniques:

- Penny stock investing therefore requires a competent research and analysis for an investor to be in a position to make the right decisions. Here are key techniques:

- Fundamental analysis: Examine company financials

- Technical analysis: Use charts and indicators

- Due diligence: Investigate thoroughly

- Red flags: Analyze what sort of activities might look so suspicious to the external eye.

| Technique | Description |

|---|---|

| Fundamental | Analyze financials |

| Technical | Study price patterns |

| Due Diligence | In-depth research |

Ways of Investing in Penny Stock

Penny stock investment requires approaches such as diversification, reasonable expectation, and good entry and exit strategies. Utilize these approaches:

- Diversification: It is important not to put all the investment eggs in one basket

- Expectations: Always go for the mid-terms and not the long-term fortunes.

- Entry/Exit: Price objectives, stop orders and losses must be established by the dealership frankly

- Risk Management: Under no circumstances should you invest a lot of your money in penny stocks.

| Strategy | Key Point |

|---|---|

| Diversify | Spread risk |

| Realistic | Moderate gains |

| Entry/Exit | Clear targets |

| Risk Mgmt | Limited exposure |

Tips and Mistakes and How to Avoid Them

Penny stocks are not for your average investor because it is associated with high risks. Be aware of:

- Pump and dump schemes: Fraudulent price inflation

- Illiquidity traps: Difficulty selling shares

- Overreliance on tips: Unverified information

- Emotional decision-making: Impulsive trades

| Pitfall | Avoidance Strategy |

|---|---|

| Pump and dump | Research thoroughly |

| Illiquidity | Set strict exit plans |

| Tips and rumors | Verify information |

| Emotional decisions | Stick to your strategy |

Future Prospect of Indian Rupees Stocks Below One Rupee

Currently, there seems to be the following favorable trends happening in the Indian penny stocks The future of Indian penny stocks looks as follows: There is a risk of regulation modification which may add to clarity, technologization is likely to enhance the trading process. External macro-economic conditions for instance flow of foreign currency for imports, are likely to affect the penny stock.

| Factor | Impact on Penny Stocks |

|---|---|

| Emerging Trends | Positive |

| Regulatory Changes | Mixed |

| Technology | Positive |

| Global Economy | Variable |

Investing in penny stocks provide a special opportunity in the context of Indian market especially for those who are ready to take the high risks associated with such stocks. What is more, they provide a possibility of prestigious revenues which are main plus of such offers. The necessary information regarding how the penny stock performs with the help of intensive research work and methods can be helpful for making the right decision.

Like any other investment, you should avoid high-risk investment such as penny stocks but at the same time take a strategic approach. If you make efforts to know what is happening in the market, avoid the mistakes most of the investors make, and expand your list of stocks, you may be in a position to tap on this growth opportunities. Please bear in mind, penny stock investing can only be successful if done with patience, discipline and learning in the dynamic market of India.