Table of Contents

Introduction

In the ever changing environment of stock trading, signals serve a very important function. Of these signals, the buy orders are one of the important precursors of investing and market movement. This guide focuses on exploring more on buying stocks with more buy order and how this information can be capitalized to make the right investments. You can check the data from NSE official site also but for saving yout time we had mentioned the top list below in the article.

Understanding Buy Orders

A buy order refers to a trader’s order that aims at buying a certain quantity of shares, at a particular price. These orders provide an immediate impact in the stock prices, which are the measures of market demand. High buy orders indicate that the investors have a good attitude towards a particular stock and may likely result to price up.

Why Monitor Buy Orders?

Monitoring buy orders offers insights into:

- Market trends.

- Investor confidence.

- Sectoral preferences.

For instance, a lift in buy orders in an ICT stock might signal a development in the company’s product, or better than expected Q results.

Main causes of buy orders Included Among them are the following Factors:

Several elements can drive a spike in buy orders, including:

- Market Sentiment: Bullish or bearish outlooks.

- Economic Indicators: GDP per capita, employment rates and so on.

- Earnings Reports: An advantage recorded in the quarterly performance inflates the buy orders.

- External Events: Market, geography, or technology, political stability, technology breakthrough or any other exciting news.

Specifying Leading Sectors by means of High Buy Orders

Sectors with consistent high buy orders often include:

- Technology: Innovation-driven demand.

- Healthcare: Stability and necessity.

- Energy: Energy Resources and Their Dependence from Global.

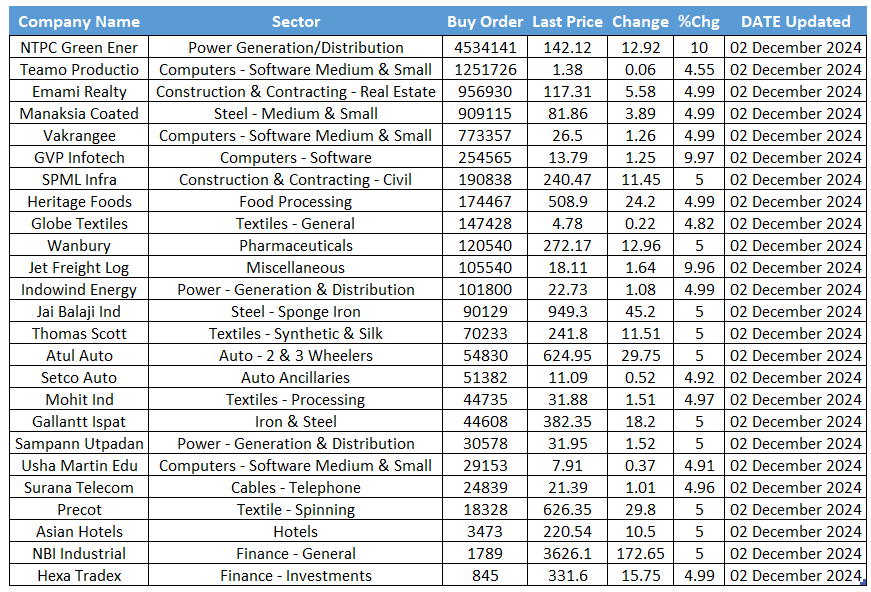

Stocks with most buy order in December 2024

Here are the top stocks in 2024 for Indian Stock Market:

Trending in buy Order

Tools like candlestick charts and order books help investors:

- Predict market movements.

- Explain what is meant by upper and lower boundaries.

- Identifying signals for the existence of bull or bear markets.

Consumer vs. Wholesale Purchase Orders

The average stakeholder targets on growth companies while institutional players target on stability. Knowledge of these factors is pretty crucial when seeking to synchronize investment approaches.

Technology for Tracking Buy Orders

Advanced technology like AI and trading platforms have over time improved the possibilities of tracking buy orders. Machine learning models enable forecast; thus investors gain a competitive advantage.

Most Common Errors Made When Analyzing The Buy Orders

- Omitting other factors; for instance, macroeconomic environment.

- Not considering, or paying inadequate attention to sell orders along with buy orders.

- Leveraging buy-order data without any diversification strategy.

How to use Buy Orders for Investments

Practical tips include:

- Employing buy orders as a measurement of stocks demand.

- Integrating data from buy-order analysis, technical analysis as well as fundamental analysis.

- We must be current with market news and public sentiment and the impacts it has on the market.

Briight Partners’ methods of tracking buy orders

Popular platforms include:

- Bloomberg Terminal: Accurate competitive intelligence.

- E*TRADE: Ease to use and navigate for tracking of trades.

- Thinkorswim: Statistic & strong parametric study analysis on bought-order patterns.

Conclusion

Increasingly, it is crucial to grasp the forces at work in today’s fast moving global financial markets. Between the variety of indicators, the stocks with the highest buy orders are most informative to analyse the performance and focus of investors. These orders show where the money goes and this information is hugely useful to trading and investing because it shows where the game is going to shift next.

Indication of buy order is useful in seeing which sectors are on demand by buyers and guessing which stock is likely to arise in the future as well as their likely prices. But it is important not to forget that buy orders are a part of it only. Adding this to other parameters such as sell orders, trading indicators, stock evaluation, and among others provide a good-rounded investment strategy.

This is particularly important for the retail investor but also applicable to the institutional parties; For instance, use of devices like the advanced trading platform and artificial intelligent analytics. In the market dynamics, therefore, flexibility and knowledge are the success factors of a business.

Finally, tracking buy orders again is not a mere task of knowing what others are buying, it is understanding why this is the case and using this information to position your investment approach. However, there are some fundamental and basic steps to be followed and certain principles to be implemented by the stock market traders and investors with the intent of being systematically successful: learning is ongoing; analysis is more comprehensive; and timing is accrued with implementation. Therefore, this article will give you the necessary knowledge to apply it in your trading and start investing with confidence.

That is all you need to prepare yourself for the best returns and dealing with the complexities of the market.

FAQs About Buy Orders

1. What do you understand by a buy order and a sell order?

Buy order means that a person wants to buy, whereas a sell order means that a person wants to sell.

2. Does a buy order make sure that the stock prices will rise?

No; this depends with the volume in proportion to the sell orders.

3. Can buy orders be canceled?

Yes, until they are executed.

4. Are buy orders public?

Some are in the light in the order book; others less so, such as hidden orders that include iceberg orders.

5. How are buy orders processed?

They means to match with sell orders which are available in the market.

6. Are there instances where institutions make bigger buy orders than individual, and inexperienced, traders?

In general, yes, because of capitals accessibility in bigger amount.tr