Table of Contents

Understanding December Dividends

Dividend stocks are shares that distribute a portion of company profits to shareholders. December dividends are crucial for income-focused investors, providing year-end cash flow in the long term run of stock market. Companies often pay dividends in December to attract investors, boost stock prices, and distribute excess profits before year-end tax considerations.

| Dividend Aspect | Importance |

|---|---|

| Income | High |

| Tax Planning | Moderate |

| Investor Appeal | High |

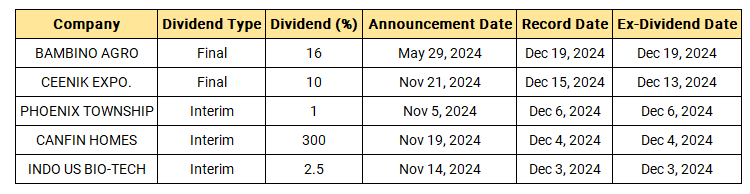

Top Dividend-Paying Stocks for December 2024

Analyzing Dividend Potential

When evaluating dividend stocks, consider these key factors:

| Factor | Importance |

|---|---|

| Dividend Yield | Immediate income |

| Dividend Growth | Long-term returns |

| Payout Ratio | Sustainability |

| Financial Health | Company stability |

• Assess historical dividend performance

• Compare yield to industry averages

• Examine company’s cash flow and debt levels

Tax Implications of December Dividends

End-of-year tax planning is crucial for dividend investors. Qualified dividends are taxed at lower rates than non-qualified dividends, impacting investment strategies. Consider:

- Qualified dividends: Long-term holdings

- Non-qualified dividends: Short-term investments

- Tax brackets: Influence overall strategy

| Dividend Type | Tax Rate (0-15% bracket) | Tax Rate (15-20% bracket) |

|---|---|---|

| Qualified | 0% | 15% |

| Non-qualified | Ordinary income rate | Ordinary income rate |

Strategies for Capitalizing on December Dividends

To maximize December dividends, consider these tactics:

- Ex-dividend date timing

- Utilizing DRIPs

- Diversification

- Growth-income balance

| Strategy | Benefit |

|---|---|

| Ex-dividend timing | Secure dividends |

| DRIPs | Compound returns |

| Diversification | Risk management |

| Growth-income balance | Long-term wealth |

Implementing these strategies can optimize your dividend income while managing risk in your investment portfolio.

Risks and Considerations

- Dividend cuts and suspensions

- Market volatility effects

- Sector-specific risks

- Overreliance on dividend income

Investing in dividend stocks carries risks. Companies may cut or suspend dividends during economic downturns. Market volatility can impact stock prices and yields. Certain sectors face unique challenges affecting dividend stability. Overreliance on dividend income may lead to portfolio imbalance and reduced growth potential.

| Risk Factor | Potential Impact |

|---|---|

| Dividend cuts | Reduced income |

| Market volatility | Price fluctuations |

| Sector risks | Industry-specific challenges |

| Overreliance | Limited growth |

As we approach the end of the year, December dividends offer investors a unique opportunity to boost their income and potentially capitalize on tax advantages. By focusing on top dividend-paying stocks, analyzing dividend potential, and understanding the tax implications, investors can make informed decisions to maximize their returns.

Remember to carefully consider the risks and develop strategies that align with your financial goals. Whether you’re a seasoned investor or just starting out, staying informed about upcoming dividends in December can help you make the most of your investment portfolio. Take action now to position yourself for potential dividend payouts and set the stage for a prosperous new year in your investment journey.

Conclusion

Dividend-paying stocks offer a compelling opportunity for investors looking to combine income generation with long-term growth. As December 2024 approaches, it’s crucial to focus on companies with a strong track record of consistent payouts, solid financial health, and growth potential within stable industries. Sectors like technology, financials, real estate, and utilities are shaping up as strong contenders for reliable dividends this season.

However, while the appeal of regular income is undeniable, it’s equally important to consider factors like market conditions, company fundamentals, and potential risks such as dividend cuts or volatility. By carefully analyzing these aspects and reinvesting wisely, you can maximize your returns and build a robust financial portfolio.

Remember, dividend investing isn’t just about the payouts—it’s about creating a sustainable strategy for wealth generation. Whether you’re a seasoned investor or just starting out, the upcoming dividend opportunities in December 2024 could be a stepping stone toward achieving your financial goals. So, stay informed, research diligently, and take advantage of the seasonal market dynamics. Happy investing!